Singapore Lender UOB Commits to 2050 Net Zero Targets

Singapore’s third largest domestic bank UOB has released details of its ambitious commitments to reach net zero by 2050.

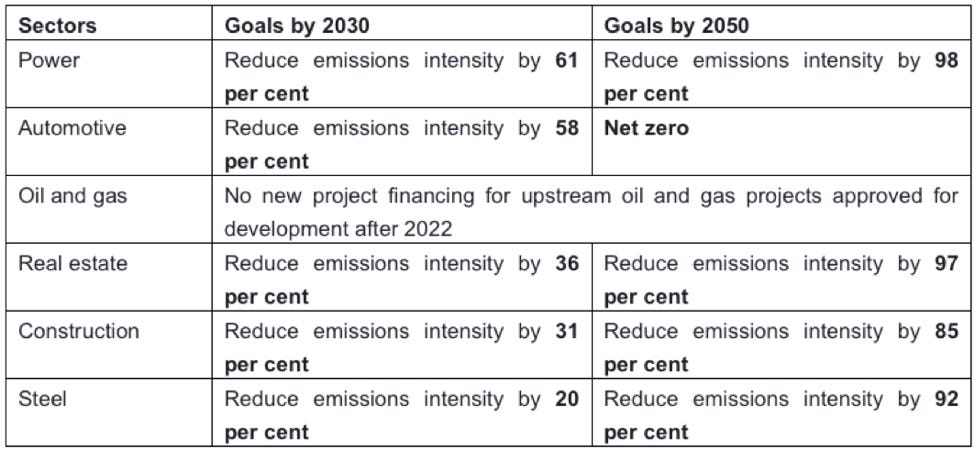

UOB’s commitments cover six sectors, which make up about 60% of its corporate lending portfolio. These six sectors are power, automotive, oil and gas, which are part of the energy value chain, as well as real estate, construction and steel, which are part of the built environment value chain.

In addition, UOB has committed to exiting financing for the thermal coal sector by 2039. This is on top of its existing prohibitions on new project financing of greenfield or expansion of coal-fired power plants and thermal coal mines.

Using internationally-recognised climate science models, UOB based its sectoral targets on regional pathways that align with global net zero goals. This approach to net zero the bank said reflects its strong belief in the need for a just transition in Southeast Asia that continues to support economic growth and improve energy access across the region’s diverse economies.

Deputy Chairman and Chief Executive Officer, UOB Wee Ee Cheong, said: “In Southeast Asia, our net zero ambitions must go hand in hand with an orderly and just transition to take into account socioeconomic challenges. Even as we cut our carbon footprint, we must ensure that people’s lives and livelihoods can continue to improve.

“It is important to balance growth with responsibility on our net zero journey. Our targets are ambitious, yet realistic, and they also meet the global goals of net zero for ASEAN.”

UOB’s commitments include interim 2030 targets to reflect the necessary near-term progress on the path to net zero. UOB is integrating its net zero plans into its business strategies and will step up its efforts in working closely with clients and other stakeholders towards decarbonisation.

It will conduct annual reporting to track progress against its net zero commitments. Over time, the Bank will expand the scope of its targets to include additional sectors as data and climate scenarios become available.

Underlining its commitment to regional and global decarbonisation efforts, UOB is joining the Net-Zero Banking Alliance (NZBA), which is made up of 121 banks from 41 countries with US$70 trillion in global banking assets.

UOB’s net zero targets and commitments for the six sectors are:

#UOB #NetZero